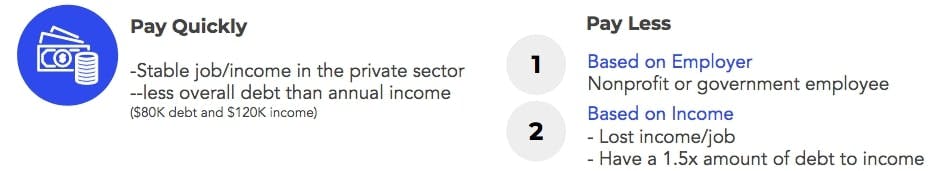

Should you pay faster or should you pay less?

Those who strive to get Public Service Loan Forgiveness (PSLF) or are on the Income-Driven Repayment plan (IDR) are on the pay less approach. Let's see which is right for you.

The conventional wisdom is to pay off your loans as quickly as possible, but that isn't the best case for everybody. Who is better to consider paying faster and who is better to pay less? I guess you can ask, is it ever better to pay less? Yes!

Video summary at the bottom.

Two factors to consider...

There are two factors to consider when trying to understand if you should pay less or pay quickly: do you work for a nonprofit or government agency or do you have a loss of income/job.

Pay less

Based on your employer. If you work for a school system, university, nonprofit hospital, city, state, or county government or any other type of charitable nonprofit, then you qualify for Public Service Loan Forgiveness. You can pay less based on your employer. It's about your employer, not your income.

Based on Income. You are also a good candidate to pay less if you earn less annually by than 1.5 times less than your total student loan debt burden. What does this mean? It means that you earn $30K and have $45K in student debt or earn $200K and have $350K in student debt.

Whether you are in the private or public sector, you can still qualify to get on an income-driven plan based on your debt to income ratio. Obviously, private sector employee loan forgiveness programs aren't as generous. This means, based on your plan, you may be paying your loans for 240 or 300 payments. Private sector employees will also have a "tax bomb" or taxation on forgiveness.

Public sector employees get their student debt forgiven in 120 on-time qualifying payments. Your loan forgiveness is not taxed. Even if you do not know if you'll be in the public sector for 10 years, the 120 payments do not need to be consecutive. Therefore, if you leave your employer and go to the private sector, you can always come back.

Items for you to consider:

- Monitor your qualifying payments. You can do this by looking at your student loan data txt file or LoanSense tells you this information on your "My Loans" dashboard.

- Know your annual paperwork filing date, called your "IDR Anniversary date". You need to file your paperwork ahead of this date annually or your payment will increase.

- Know which paperwork you should be filing annually - if you are trying to qualify for PSLF, then file two forms of paperwork every year- your employer verification form and your IDR renewal paperwork. If you are only trying to qualify for loan-forgiveness through an income-driven plan and do not work for a qualifying "public service" employer, then you only need to file one form.

- Know what plan you should be on to save the money money - REPAYE, PAYE, IBR or ICR.

- If you are married, understand how filing your taxes will affect your student loan payments. Can you file separately and save more money? How do you know? We have a marriage tax filing calculator that will tell you. Check out this article.

Pay Quickly

If you are in the private sector, have stable income and have less total student loan debt that annual income, then paying faster makes sense- if you are able.

Here's an example: Let's say you have $80K in student loan debt and earn $100K annually, then you fall into this category. Especially, if you work in the private sector, paying your student loans off as quickly as possible is the right approach for you.

Questions for you to consider:

- Can you afford to put a little more money towards your monthly payment and pay your loans off faster? If so, how much would you have to pay and when would you want to get your "loan-free" date? LoanSense has a personalized calculator for you to understand your interest and time savings.

- If you would like to pay your loan off quicker, have a stable job, and are close to cutting your payoff timeline to 5 years, consider refinancing your loan. It's important to understand the cons of refinancing though. Don't trust every student loan blog and let them push refinance on you. Read the article here on the pros and cons of refinancing.

If you have any issues with your student loans, don't forget we're available to assist.

Get started now!