Mortgage DTI Calculation Guideline

Catalina Kaiyoorawongs|Mortgage|July 03, 2023

These FHA guidelines calculate your debt-to-income ratio in a new way that can benefit you.

What is Debt to Income?

It is your monthly debt payments divided by your monthly income. These are your minimum credit card debt, car loan payment, and student loan payments.

The back-end ratio compares what portion of your income is needed to cover all of your monthly debts. These debts include housing expenses in addition to loans, credit cards, and other monthly credit obligations. It should be under 46%.

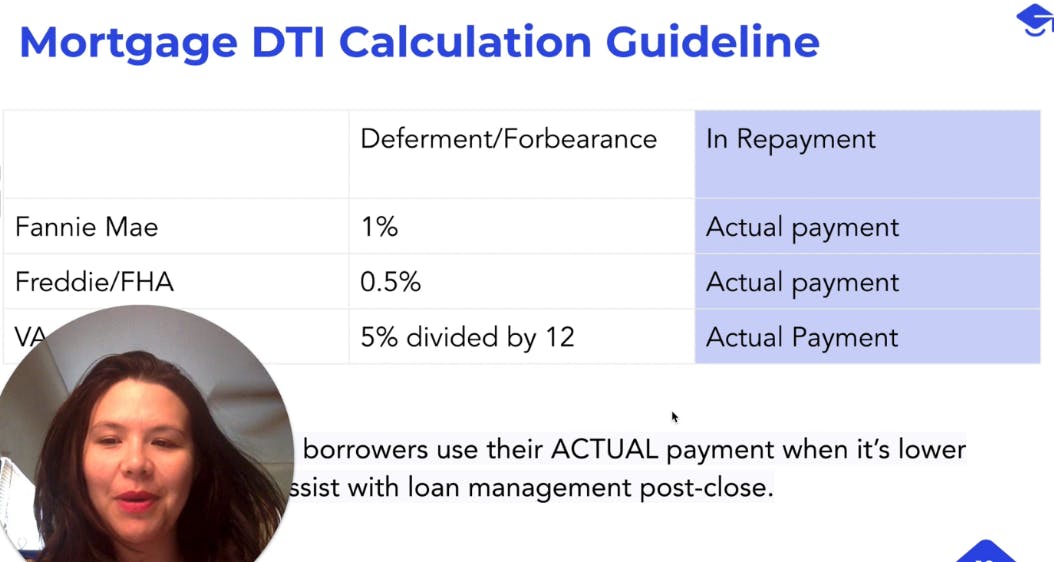

Pro Tips: How do student loans impact DTI?

- Understand what Mortgage loan you qualify for.

- How do they treat and recognize student loans?

- What action can you take to get a new plan that lowers and minimizes how student loans are calculated on the DTI?

This helps chances of getting approved for a mortgage dramatically since the DTI calculation has been modified to benefit borrowers and FHA loans allow for lower credit scores and down payment amounts.