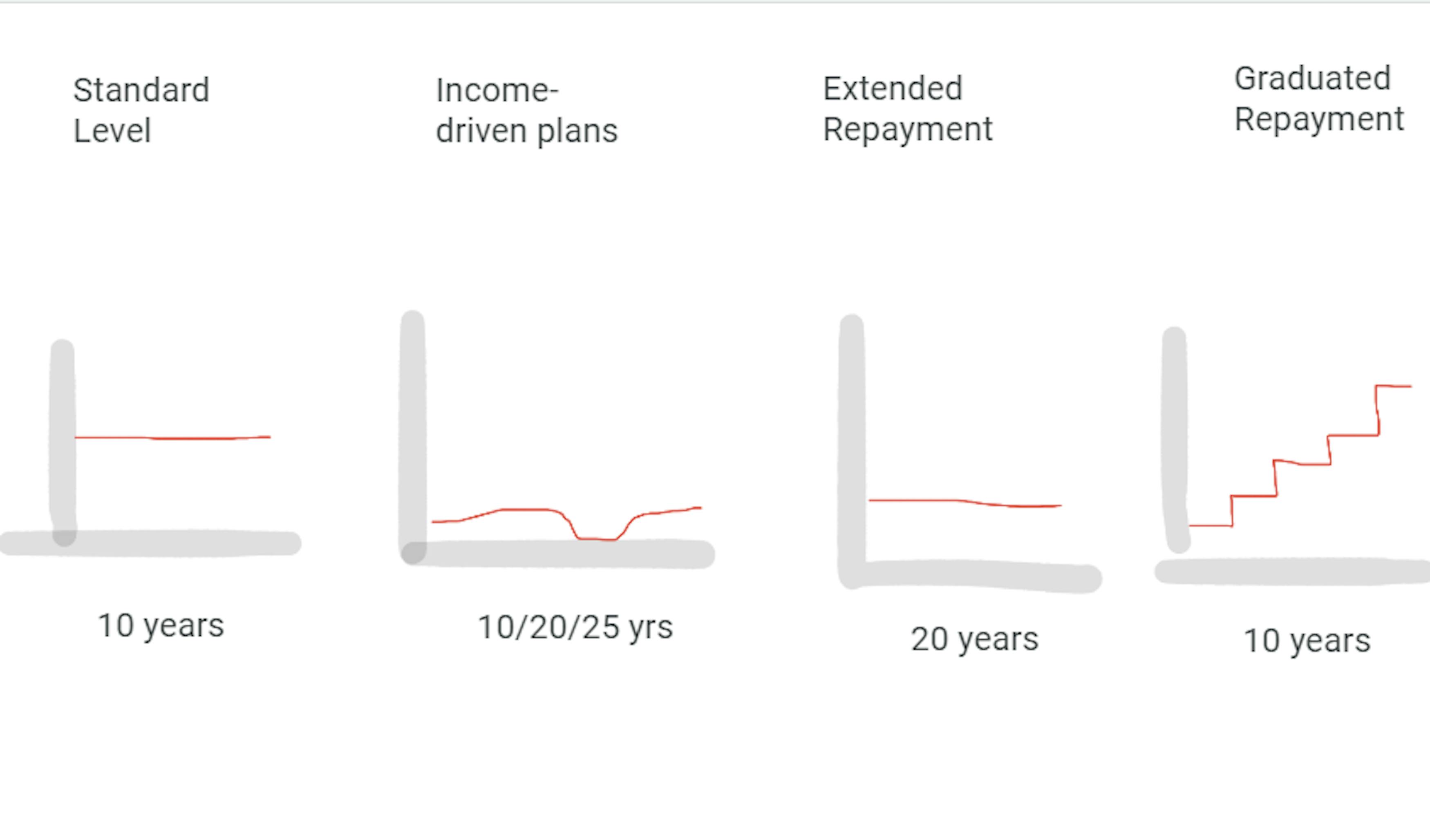

Loan Plans at a Glance - guide to student loan payment plans

This document is a quick guide to help users understand a few basic facts - is the plan they are on an income-driven plan, which is required for Public Service Loan Forgiveness (PSLF). What are the key plan terms and differences?

Standard Repayment Plan

Payments are a fixed amount that ensures your loans are paid off within 10 years (within 10 to 30 years for Consolidation Loans).

This is not an income-driven plan. It is not a good option for those seeking Public Service Loan Forgiveness (PSLF).

Graduated Repayment Plan

The graduated repayment plan starts with lower payments that increase every two years. Payments are made for up to 10 years (between 10 and 30 years for consolidation loans)

This is not an income-driven plan, which means you will not qualify for Public Service Loan Forgiveness or interest relief as you would on an income-driven repayment plan. Even more detail here.

Extended Repayment Plan

Payments may be fixed or graduated and will ensure that your loans are paid off within 25 years. If your extended plan is graduated, then payments will rise over time. You will pay back significantly more interest than on a 10-year plan.

This is not an income-driven plan, which means you will not qualify for Public Service Loan Forgiveness or interest relief as you would an income-driven repayment plan. Even more detail here.

Revised Pay As You Earn Repayment Plan (REPAYE)

This is an income-driven plan.

Your monthly payments will be 10 percent of discretionary income. Payments are recalculated each year and are based on your updated income and family size. Unlike PAYE though, the monthly payment can exceed the 10-year standard plan payment.

Pay As You Earn Repayment Plan (PAYE)

This is an income-driven plan.

Your monthly payments will be 10 percent of discretionary income, but never more than you would have paid under the 10-year Standard Repayment Plan. Payments are recalculated each year and are based on your updated income and family size.

Income-Based Repayment Plan (IBR)

This is an income-driven plan.

Your monthly payments will be either 10 or 15 percent of discretionary income (depending on when you received your first loans), but never more than you would have paid under the 10-year Standard Repayment Plan. Payments are recalculated each year and are based on your updated income and family size.

Income-Contingent Repayment Plan (ICR)

This is an income-driven plan.

Your monthly payment will be the lesser of 20 percent of discretionary income or the amount you would pay on a repayment plan with a fixed payment over 12 years, adjusted according to your income.

Payments are recalculated each year and are based on your updated income and family size.

Income-Sensitive Repayment Plan

This is an income-driven plan.

Your monthly payment is based on annual income, but your loan will be paid in full within 15 years.

Deferment

You are in deferment on your 6 month grace period. Interest accrues during this period. This means your balance will increase and you’ll pay more over the life of your loan.

Any period of deferment will not count toward loan forgiveness. We recommend you enter into an income-driven repayment plan if you need to lower your payment.

Forbearance

You are in forbearance and interest accrues during this period. This means your balance will increase and you’ll pay more over the life of your loan.

Any period of forbearance will not count toward loan forgiveness. We recommend you enter into an income-driven repayment plan if you need to lower your payment.

If you have any issues with your student loans, don't forget we're available to assist.

Get started now!